how to lower property taxes in ohio

Begun in the 1970s for low-income seniors the exemption was expanded in 2007 so that all Ohioans over 65 are eligible. 10 penalty on the unpaid current half tax.

Find Tax Help Cuyahoga County Department Of Consumer Affairs

If you see an error on your property card or you think your assessment is too high you have the right to file an appeal and you should definitely exercise it.

. This means two things. But the time to. School districts generally receive between 65 percent to 70 percent of property taxes collected meaning that they are the government entity most affected.

Your property tax information will typically show several different types of values. If youre a homeowner you probably already know that recent tax legislation means you can now deduct only up to 10000 worth of property taxes from your federal tax bill. JsolieEGetty Images Tax assessors dont always get it right.

Has an average score of 57. Fortunately there are two possible ways to reduce your property tax burden. The homestead exemption allows low-income senior citizens and permanently and totally disabled Ohioans to reduce their property tax bills by shielding some of the market value of their homes from taxation.

If you are on CAUV this is NOT the value. Delaware County collects the highest property tax in Ohio levying an average of 373200 148 of median home value yearly in property taxes while Monroe County has the lowest property tax in the state collecting an average tax of 69200 08 of median home value per year. Property tax rollbacks.

February 1 2018. Since my property tax bill is now twice my mortgage payment Im on it. LOWER PROPERTY TAXES Last year the Ohio General Assembly made changes to the Homestead Exemption which provides for annual property tax relief to Eligible Homeowners all homeowners 65 and older and all totally and permanently disabled homeowners.

July 9 2022 - July 18 2022. You can find this on the Hamilton County Auditors. The first method is available to all Ohio homeowners.

The exemption offers homeowners who are disabled or over 65 years old a reduction of. Use our free Ohio property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent assessment and local property tax statistics. 01988 402000 07766 951372.

In 2005 as part of a broader series of tax reforms the General Assembly lim ited the 10 percent rollback to all real property not intended primarily for use in a business activity. A deferral means you can delay paying property taxes as long as you meet the age and income guidelines. Buried in Ohios latest budget is a measure altering the Homestead Exemption -- a property break for seniors and the disabled.

Later that year in 2007 it became apparent that General Assembly expansion wouldnt only apply to senior citizens regardless of their incomes. Appeal the Taxable Value of Your Home. Since 1971 a 10 percent reduction or rollback has ap plied to each taxpayers real property tax bill.

The share price for SmartAsset was 929 in 2018. Appeal Your Assessment House on Dollar Bills. Essentially the homestead exemption allows eligible individuals to reduce the market of value of their home for tax purposes.

You cant make any deductions and since you cant dispute the Town Tax Rate the only way to lower your property tax rate is by lowering your Assessed Value. First if the owner is seeking a decrease in property value of more than 50000 the BOR will notify the local school district. In order to lower your current property tax first evaluate your current property record card This is the official description of your house.

March 8 2022. Yet last year only about 4000 appeals were filed to contest property values. A constitutional amendment allowing senior citizens to pay lower property taxes in Ohio was approved by voters in 1970.

The exemption which takes the form of a credit on property tax bills allows qualifying homeowners to exempt up to 25000 of the market value of their homes from all. The second depends on whether you meet certain qualifications. As detailed by the Ohio Department of Taxation the homestead exemption allows qualifying individuals to remove a maximum of 25000 from the market value of their property in the form of a tax credit.

5 penalty on the total unpaid 2021 real estate tax. The exact property tax levied depends on the county in Ohio the property is located in. Give the assessor a chance to walk through your homewith youduring your assessment.

The full market value of the property. 2 Interest assessment on unpaid prior years delinquent real estate taxes. 10 penalty on the total unpaid 2021 real estate tax.

Here are six strategies that you can use to lower your property tax bill. How to Lower Your Property Taxes in Ohio. The property tax then becomes a lien on your house which gathers interest as long as it.

Below is a table that shows average effective tax rates median real estate tax payments and home value information for each county in Ohio. In the past many homeowners were deemed ineligible for the Homestead Exemption due to. Our property records tool can return a variety of information about your property that affect your property tax.

It is helpful to have your property tax bill handy for this explanation of general property tax information and how it relates to CAUV. Dont build or make changes to your curbside just before an assessment as these steps may increase your value. Claim the homestead exemption if you are eligible.

If you meet those qualifications you can seek tax relief using both methods. If the school district decides to become involved with the owners case its counsel is allowed to. Market or appraised value.

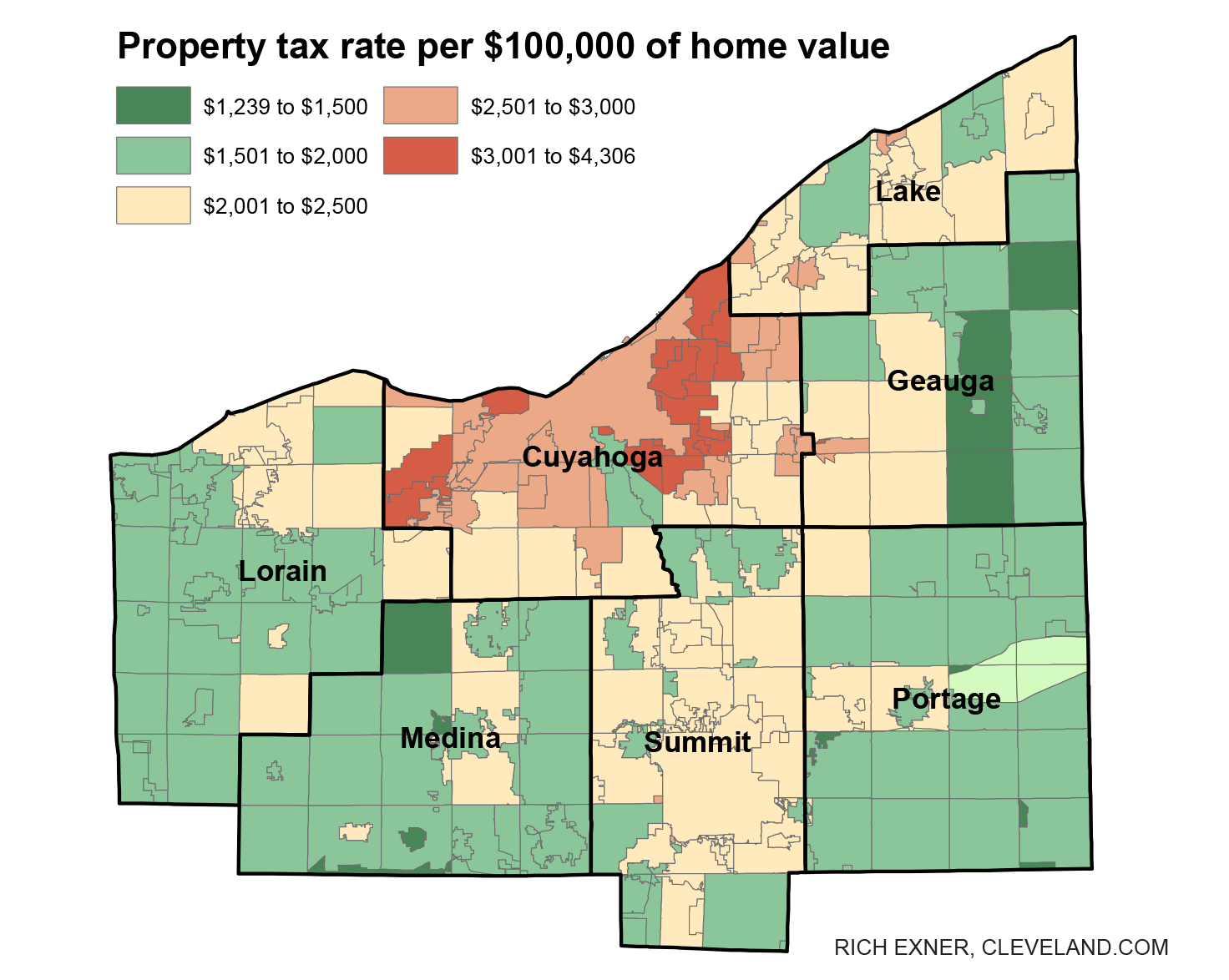

In Ohio property tax rates are on average one percent. Every year I take a few steps to lower my property taxes. CLEVELAND Ohio - There are more than 500000 parcels in Cuyahoga County.

Wide range of floor coverings to view in our store.

Ohio Property Tax Calculator Smartasset

Brecksville Finance Property Taxes

Not All Senior Citizens Still Qualify For Ohio Property Tax Discounts Homestead Savings Calculator Cleveland Com

States With Highest And Lowest Sales Tax Rates

Pay Property Taxes Online County Of Columbiana Papergov

Real Property Tax Homestead Means Testing Department Of Taxation

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Distributions Real Property Tax Rollbacks Overview Department Of Taxation

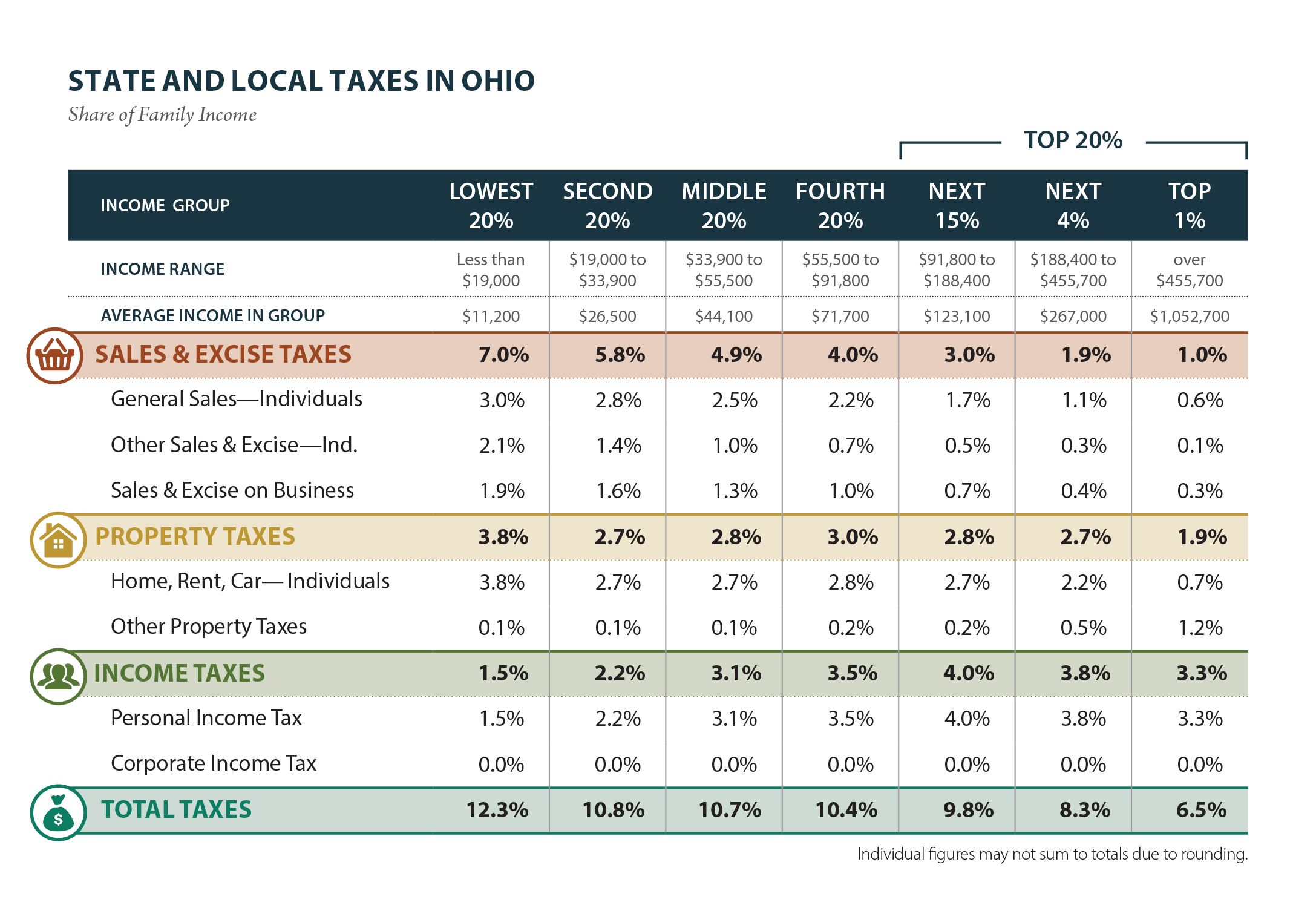

Ohio Who Pays 6th Edition Itep

How To Lower Appeal Real Estate Property Taxes In Cuyahoga County Updated 2021 8 Min Read

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Compare New Property Tax Rates In Greater Cleveland Akron Part Of South Euclid Now Has Top Rate In Northeast Ohio Cleveland Com

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

Brecksville Finance Property Taxes

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com